Whether you and your partner are considering sharing financial obligations or are already dividing expenses in your household, you may find yourself looking for tips on how to split finances as a couple.

For example, how do couples split finances when their income levels, personal expenses, or financial values differ? What are some of the most popular approaches to splitting finances, and are there any best practices to adopt or pitfalls to avoid?

Key Takeaways About Splitting Finances

- Stay true to both of you: There is no “one size fits all” approach to splitting finances. Explore what works for you—both individually and as a couple—and let your approach evolve with your changing needs.

- Work out a system: The basic elements include deciding which expenses you’ll share jointly, setting up a payment process, and assigning responsibility for each bill.

- Explore various methods: Some options include splitting bills 50/50, an income-based approach, the roommate method, setting up a joint account, or delegating particular bills to each person. You might even discover your own unique approach.

- Agree on each person’s responsibilities: Confirm who is responsible for each bill so you avoid missing payments, acquiring fees, having a lapse in service, or harming your credit score.

Is Splitting Bills Common in a Relationship?

While splitting bills is common in a relationship, it doesn’t mean it’s required or that there’s a universally “right” or “wrong” way to do it. And while you and your partner might decide to split utilities or meals out, that doesn’t mean you have to split all your bills all the time, or that you can’t treat each other to something special when you want to.

What matters is being financially transparent and having open communication about money so that your approach to splitting bills reflects and respects both of you.

The approach you both decide on could also be determined by your age or life stage. For example, a recent survey by Bankrate1 showed key differences across generations:

- Baby Boomers (60-78 years): 44% fully combine finances, the most common approach for this age group. 16% keep finances completely separate, and 40% use a mix of joint and separate accounts.

- Gen X (44-59 years): 36% fully combine finances. 24% keep finances completely separate, and 40% prefer a mix of joint and separate accounts.

- Gen Z (18-27 years): 34% fully combine finances. 38% keep finances completely separate, and 28% use a mix of joint and separate accounts.

Of course, your approach to how to split bills as a couple may buck these trends, and that’s perfectly healthy, as long as it works for both of you.

Whether you’re currently married or considering it, you may find yourself asking, “How should couples split bills once they’re married?” While this article covers all couples, including spouses, check out Improve Your Marriage and Finances P.1 for more on navigating money in marriage.

How Should Married Couples Split Bills?

A common question among unwed or newlywed couples is, “How do married couples split finances?” A good place to start is having conversations with your significant other about how to split finances when married. It’s important to understand that you could be legally responsible for your partner’s financial obligations once you’re married.

For example, if your partner makes purchases on a joint credit card, you might be required to pay off the balance if they don’t. However, getting married does not require you to combine all your finances. If you and your partner currently keep your finances separate and it’s working for you, marriage doesn’t require you to change that approach. As always, conversation is key.

Determine Joint Bill Expenses

While there’s not a single best way to split bills with a partner, identifying which of your expenses you share the benefit of can help you decide how to split finances when living together.

You may want to continue paying separately for bills that only one person brought into the household, such as individual credit card or student loan debt.

Here are some expenses that couples might determine they share the benefit of:

- Housing: Rent or mortgage

- Insurance: Homeowners, renters, auto, health, life

- Utilities: Internet, cable, electricity, natural gas or propane, water, sewer, garbage, cell phone plans

- Subscriptions and streaming services: TV, music, print or online publications like newspapers or magazines

- Joint loans: Jointly acquired loans such as home, auto, credit cards

- Child-related costs: Child care, clothing, enrichment activities, medical bills, insurance

- Pet-related costs: Food, supplies, veterinary care, pet sitters

- Joint vacation and recreational costs: Flights, hotels, ground travel, event tickets, shared hobby equipment

Once you’ve identified joint bills, look at the amount of each bill, consider seasonal fluctuations, and determine the average payment amount and frequency of the bill: every month, every other month, or once a year.

Input the due dates on a shared calendar or app so both of you can see the due dates of your joint bills.

Finally, decide how to split the cost of joint bills and who will handle making the payments.

Different Methods Couples Use to Split Bills

Now that you’ve done the work of determining which bills to split, you’re probably wondering, “How should couples split bills?” Should they split them 50/50, based on income, or using some other method?

Below, we share common methods couples use to split bills. But remember that what’s best for your relationship is what works for both of you—and that could be a hybrid approach, a unique solution, and even one that shifts over time as your relationship grows or circumstances change.

1. 50-50 Bill Split

Should couples split bills 50/50? While there’s no right or wrong answer to this question, some couples feel that if they get equal benefit from the product or service, they should pay for it equally as well. If you each earn a similar amount of income, this may feel like a fair approach to both of you. However, if your income levels differ, this approach may feel more burdensome for the person who earns less, which could create stress in the relationship.

2. Income-Based Percentage Expense Split

Splitting bills based on income is another way couples divide their household expenses. With this method, couples first determine what percentage of their household income each of them earns.

EXAMPLE

If Jess earns $55,000/year and Steph earns $30,000/year, their total annual household income is $85,000. If we divide Jess’s income by their household income, we find that Jess earns 65% of the household income, and Steph therefore earns the remaining 35%.

Step 1: Calculate Income Percentages

Jess’s income: $3,300/month

Steph’s income: $1,800/month

Total household income: $5,100/month

- Jess: $3,300 ÷ $5,100 = 0.65, or 65%

- Steph: $1,800 ÷ $5,100 = 0.35, or 35%

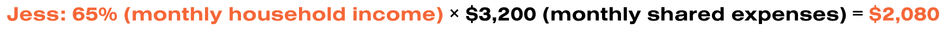

Let’s imagine Jess and Steph have $3,200 in shared bills each month. Jess’s portion of the shared bills would be 65%, or $2,080, while Steph’s portion of the shared bills would be 35%, or $1,120.

Step 2: Apply Percentages to Monthly Shared Expenses

Total shared bills: $3,200/month

- Jess: 65% × $3,200 = $2,080

- Steph: 35% × $3,200 = $1,120

The example above illustrates how to split bills based on income, but other factors like unpaid household responsibilities may also be worth considering. For instance, if one partner works part-time to care for children, a couple might choose to factor in the value of that childcare when dividing expenses.

Another factor to consider is whether one partner covers shared benefits, like health insurance, through payroll deductions. That contribution might reduce their take-home pay and could be accounted for when splitting expenses.

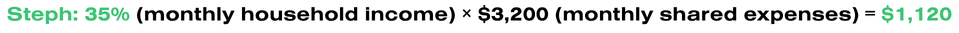

3. Roommate Approach to Splitting Expenses

Another approach to splitting expenses is one commonly used among roommates—each person pays for the portion of the space and utilities they use. For example, if one person works from home and uses a spare bedroom as their home office, perhaps they’ll pay for 2/3 of the rent and utilities, considering they use more of both.

Taking a roommate-style approach with your partner might sound awkward, but clear boundaries and expectations can strengthen any relationship. After all, healthy roommate habits often translate into healthy relationship dynamics.

When deciding how to split finances when living together, consider each person’s use of shared resources and whether the roommate-style approach—or aspects of it—make sense for your arrangement.

4. Joint Account Approach to Splitting Expenses

When deciding how to split bills with a spouse or partner, some couples choose to open a joint account for shared expenses. The choice is personal, but a joint account can offer several benefits.

First, it offers transparency and empowers both partners to stay informed about their shared financial responsibilities. It also simplifies tracking—all shared expenses are in one place—and can streamline budgeting or tax prep when everything is linked to a single account.

While couples may still decide to delegate all or some of the bill paying to one partner, having equal access to the account can keep both parties informed and reassured.

But how do couples split finances if there’s not enough money in the joint account to cover their shared expenses? That’s where automatic transfers from another account can help. For example, linking your joint checking account to a shared savings account provides a useful backup and peace of mind. Regularly checking the account for sufficient funds is also a key habit for maintaining healthy shared finances.

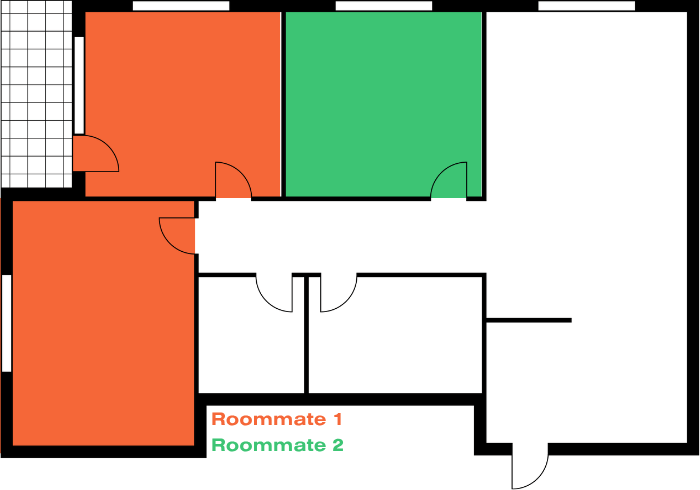

5. Yours and Mine Approach

A yours-and-mine approach means you and your partner agree on which bills each of you will handle. For example, one person might cover rent while the other takes care of groceries or utilities. Some couples might find this approach lessens the burden of bill paying by splitting the responsibility.

It’s not always easy to figure out how to split finances while living together, and it may take trying a few different approaches to discover what works best. A yours-and-mine model can be a practical starting point, especially if you’re not ready to open a joint account. Regardless of the method you settle on, if it works for both of you, it’s a win-win!

How To Manage Shared Expenses

When considering how to split expenses as a couple, many couples turn to free websites like bestbillsplitter.com or kittysplit.com, or apps such as Splitwise or Honeydue to track who owes what. You can also use a spreadsheet or budgeting software to stay on top of your shared finances. Again, there’s no right or wrong—only what works for both of you.

Once you’ve chosen a method, decide who will actually submit payments. Maybe one person enjoys managing the bills, or maybe you’ve divided them based on a “yours-and-mine” approach. Whichever you choose, the best way to split bills with a partner is the one that fits your relationship and ensures nothing gets missed.

Automating payments is one of the easiest ways to avoid late fees or lapses in service. You might set up recurring transfers from your personal accounts to a joint checking account, or use autopay from whichever account handles each bill.

Finally, schedule regular financial check-ins.2 Whether monthly or quarterly, these help you adjust to changes in income, expenses, or goals. Transparency—especially around missed payments or overspending—keeps your system running smoothly.

Sharing expenses isn’t just about staying organized—it’s about building something together. When both partners feel informed, involved, and respected, managing money together can strengthen your relationship.

For more tips on budgeting with your sweetheart, check out How to Budget as a Couple.

References

- Rossman, Ted, and Sarah Gage. “The ‘Yours, Mine and Ours’ School of Budgeting.” Bankrate, February 2024. https://www.bankrate.com/credit-cards/news/yours-mine-and-ours-budgeting/ Accessed May 12, 2025.

- Donnelly, Grant E., Ximena Garcia-Rada, Jenny G. Olson, Hristina Nikolova, and Michael I. Norton. “Couples Underestimate the Benefits of Talking About Money.” Centre for Economic Policy Research, July 2023. https://cepr.org/system/files/2023-07/Couples%20Underestimate%20the%20Benefits%20of%20Talking%20About%20Money%20-%20E.%20Donnelly%20Ximena%20Garcia-Rada%20Jenny%20G.%20Olson%20Hristina%20Nikolova%20Michael%20I.%20Norton_0.pdf Accessed May 12, 2025.