Budgeting with a partner can strengthen more than just your finances — it can bring you closer together. In fact, research shows that couples who budget and make financial decisions together report higher relationship satisfaction and lower financial stress — thanks to better communication and a greater sense of control over their finances.1

Whether you’re just starting out or reevaluating your current approach, learning how to budget as a couple can help you navigate uncertainty, build trust, and stay focused on what matters most.

Budgeting Strategies for Couples

Budgeting for couples is different from budgeting on your own — and that’s part of what makes it so important. You’re not just managing one set of priorities anymore; you’re working to align two. That means compromise, communication, and a willingness to stay flexible as your life and goals evolve.

You might choose to merge finances entirely, keep some accounts separate, or use a combination of both. There’s no one-size-fits-all model — just the approach that fits your relationship, values, and lifestyle.

No matter what you choose, the tips below are designed to help you manage money together in a way that feels fair, balanced, and aligned with your shared future.

1. Discuss Your Financial Values

The best way to budget as a couple doesn’t start with spreadsheets — it starts with a conversation. Before jumping into the numbers, take time to talk about what money means to each of you.

You might ask:

- What did money look like in your family growing up?

- What’s something you’ve always wanted to save for?

- What kind of lifestyle do you hope to build together?

This isn’t about agreeing on everything right away. It’s about understanding each other and laying a foundation for the decisions you’ll make together. If you’d like help navigating the conversation, check out Improve Your Marriage and Finances P.1 for some helpful tips.

2. Create an Emergency Fund

An emergency fund is one of the most important steps when creating a budget for a two person household. Think of it as your rainy-day cushion—a dedicated account you can tap when life throws something unexpected your way like a surprise bill or a loss of income. Having money set aside can make challenging times a little easier and prevent you from accumulating debt.

A good rule of thumb is to build up enough savings to cover three to six months of your basic living costs — but the exact amount depends on your personal situation. That might sound like a lot, but it’s okay to build it gradually. The most important thing is to choose a goal based on what you actually need — and then build toward it steadily.

You can build your emergency fund in a joint savings account or separate ones—whatever fits your way of managing money together. Either way, the key is to automate contributions so saving becomes a habit. Even small monthly transfers add up over time.

WECU’s Stash Savings account makes it easy to start setting money aside. For more background, explore What Is an Emergency Savings Fund, and Why Is It Important? or How much money should I have in my emergency savings?.

3. Plan Short-Term, Medium-Term, and Long-Term Goals

Every couple has financial goals — some are smaller and closer on the horizon, while others may take years of planning and saving. Mapping them out by timeframe (short-, medium-, and long-term) can make the process feel more approachable and help you see how each goal fits into the bigger picture. These conversations are also a chance to check in on what matters most — to each of you individually and as a couple — so you can start prioritizing together. You don’t need to have every goal perfectly defined from the start, but making space to talk about all three timeframes early on is an important part of how to budget as a couple.

Want help setting realistic goals? Try a few SMART financial goals as a starting point.

Examples of Short-Term Goals

Short-term goals (within the next three years) are often the most immediate and attainable. They can be fun, practical, or foundational to your larger financial picture.

- Build an emergency fund with three to six months of expenses

- Pay off a credit card or small personal loan

- Save for a weekend getaway or vacation

- Set aside money for gifts (weddings, holidays, birthdays, graduations, etc.)

These short-term goals can be a great opportunity to test out budget ideas for couples— whether you use a savings account, an envelope system, or even a simple jar to set money aside.

Examples of Medium-Term Goals

Medium-term goals (three to five years) often support bigger moments and milestones that are a few years down the road.

- Save for a used or new car

- Take a bigger vacation, like international travel

- Pay down student loans or a larger chunk of debt

- Make moderate home improvements

This stage of budgeting for couples often involves goals that take some more time to build — and may shift along the way. Regular check-ins and automated savings can help you stay on track, especially for larger purchases like a car. WECU’s Vehicle Loans are a great resource when you’re ready.

Examples of Long-Term Goals (More Than 5 Years)

These are your big-picture goals — the ones that shape your long-term future. They can take more time, but like any other goal, they become more achievable with thoughtful planning.

- Put a down payment on a home

- Save for a child’s college education

- Plan for retirement

- Budget for major home renovations

These goals often form the foundation of a budget for a married couple. WECU offers helpful tools like the Saving for College in Washington State guide, Goal Savings Calculator, and Home Affordability Calculator to support your planning.

4. Calculate Your Combined Income

To make a budget that supports your shared goals, it’s important to understand your total household income. That means listing everything — not just your salaries, but also bonuses, tips, freelance work, side hustles, or other recurring sources. Knowing how much you bring in together gives you the information you need to plan effectively.

This is also the point where many couples decide how they want to manage their money. Some combine all of their income into a shared account, while others prefer to keep finances partially or fully separate. There’s no one-size-fits-all solution — just what works for your relationship and your comfort level.

If one or both of you have fluctuating income, it can help to build your budget with some flexibility. While there’s not one best way to budget as a couple, a common approach is to revisit your income regularly and adjust your plan as needed — so you stay aligned even when your paychecks don’t always look the same.

5. Track Your Expenses

Once you know your income, the next step is figuring out where your money is going. Tracking your expenses — both individual and shared — gives you a clearer picture of your habits and helps you make smarter decisions together. Start by listing everything you spend money on, from rent and groceries to smaller, everyday costs like subscriptions, online orders, or coffee runs.

You don’t need a complicated system to get started. Whether you prefer a budgeting app, a spreadsheet, or even a shared notebook, the best approach is simply the one you’ll actually use. Make sure to include both fixed expenses (like rent, loan payments, or insurance premiums) and variable ones (like dining out, shopping, or gas). It’s also important to note periodic expenses — like annual memberships, holiday gifts, or car registration — so you’re not caught off guard when they pop up.

Over time, this habit helps reveal patterns, such as categories where you might be overspending or recurring costs you haven’t noticed. Spotting these trends is a simple but effective way to uncover identify how to save money as a couple.

6. Categorize Your Spending

After tracking your expenses for a month or two, take time to sit down and review them together. This step is about clarity — not judgment. The goal is to understand where your money is going and how it supports your needs, goals, and lifestyle. Start by grouping your expenses into categories, such as housing, groceries, transportation, debt payments, and entertainment. Doing this together helps you make informed decisions and supports a more balanced budget for a two person household.

As you sort through your expenses, it’s helpful to separate them into two broad types: essential (needs) and discretionary (wants). Essentials include things like rent or mortgage payments, groceries, utilities, insurance, and debt payments — costs that keep your household running. Discretionary spending might include dining out, subscriptions, hobbies, or gifts. These aren’t inherently “bad” — they just require more flexibility. You may also find that what feels essential to one person might not seem as important to the other. That’s okay — this is the stage where you both learn how to respect and balance each other’s priorities.

Before deciding how much to spend in each category, consider setting aside money for savings first — especially if you’re working toward specific goals. Prioritizing contributions to your emergency fund, retirement, or other shared savings can help ensure those goals stay on track before extra funds go toward more flexible spending.

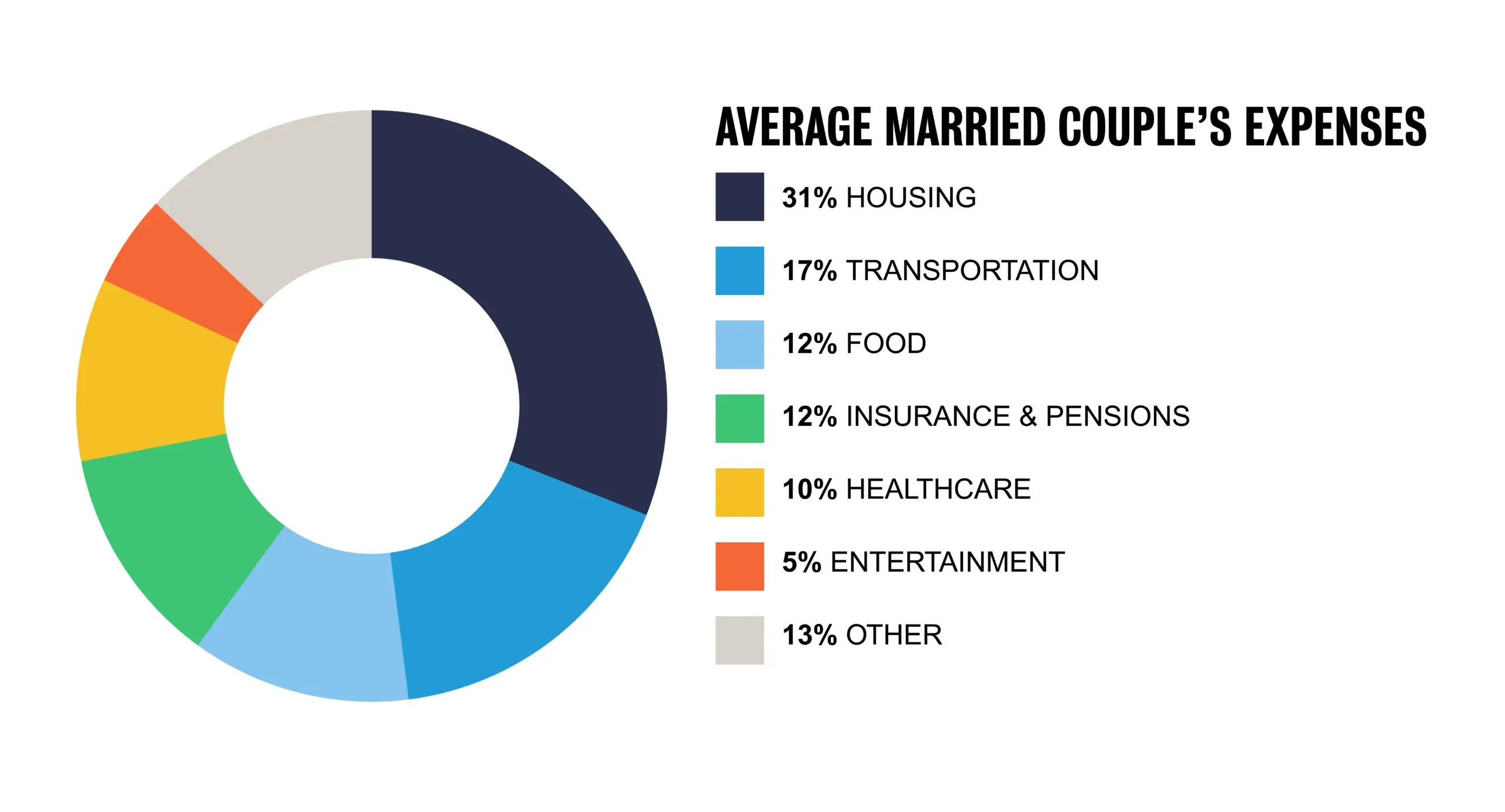

If you’re curious how other couples allocate their budgets, take a look at the average spending breakdown for married households2 below — not as a fixed rule, but as a helpful benchmark as you build your own plan.

7. Choose a Budget Method That Works for You

Once you’ve got a handle on your income and expenses, the next step is finding a budget structure that fits how you live and spend. There’s no perfect method — just the one that works best for both of you. Some couples prefer a simple framework, while others like to get into the details. The important thing is that you both feel comfortable, clear, and supported in the process.

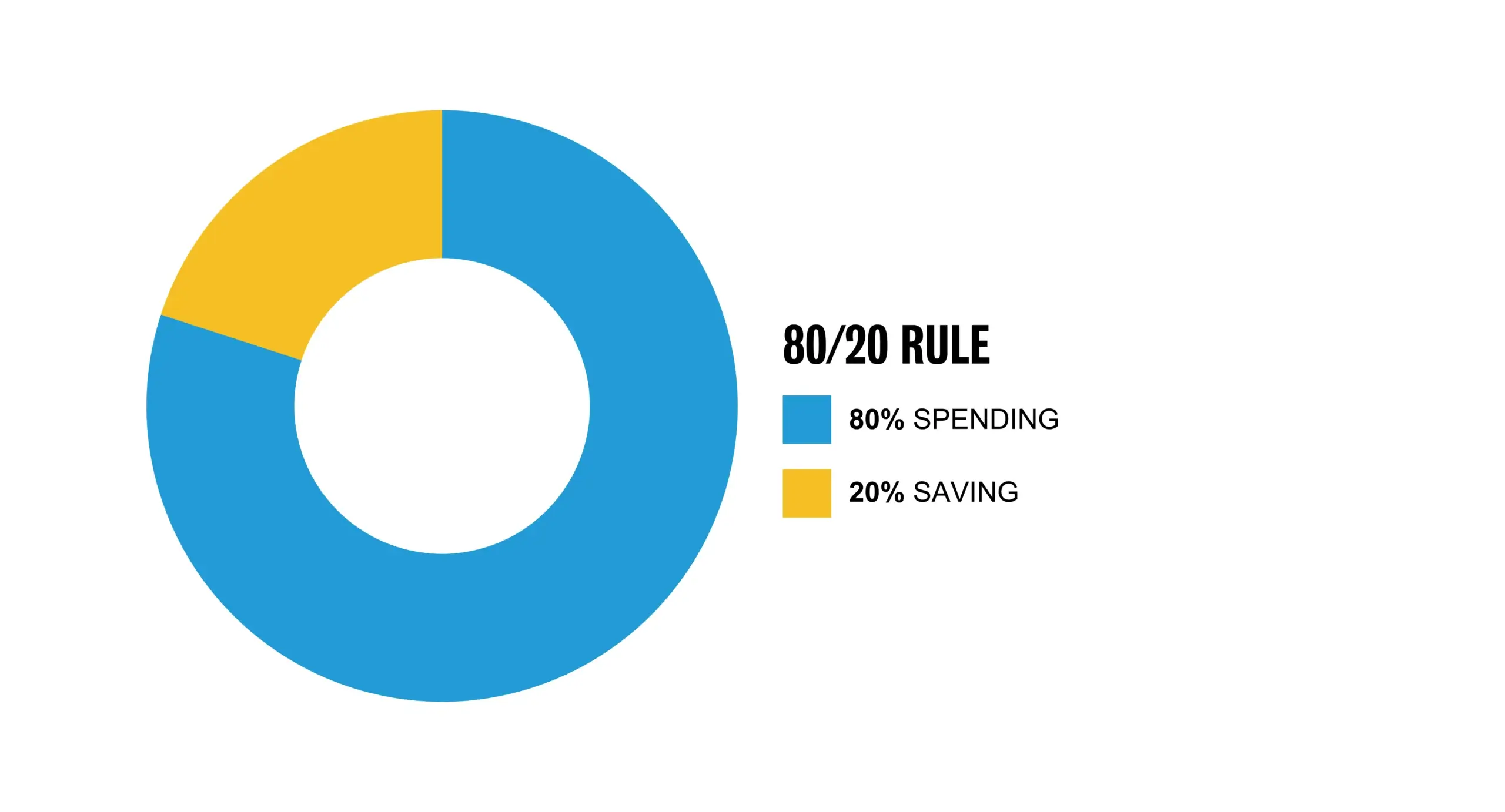

One popular approach is the 80/20 rule, where you spend 80% of your income on needs and wants, and put 20% toward savings. It’s simple and flexible, especially if you’re just getting started. This method aligns with the “pay yourself first” strategy, which encourages saving before spending on other expenses.3

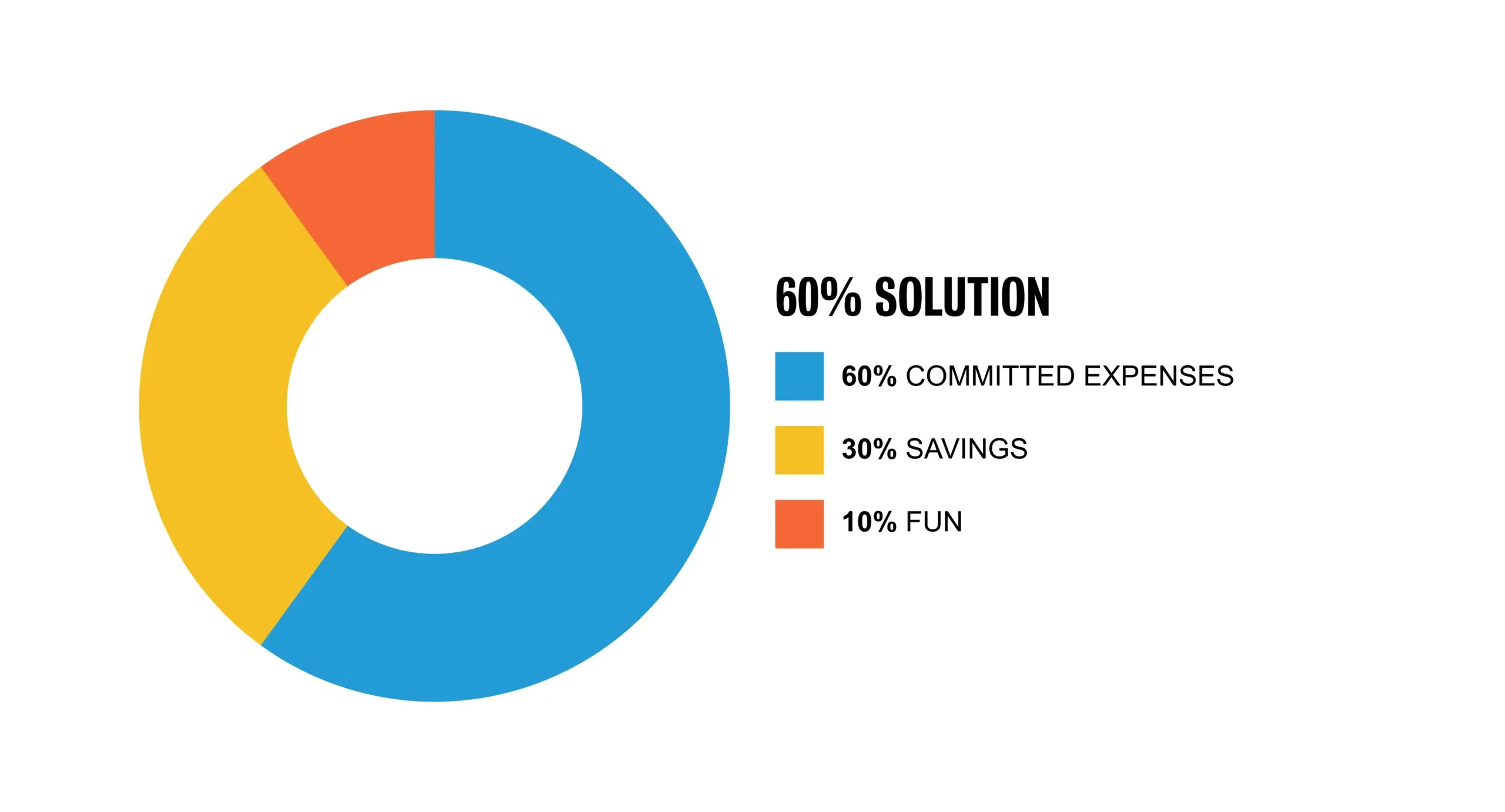

Another option is the 60% Solution, which suggests using 60% of your income for committed expenses like housing, food, and insurance. The remaining 40% is evenly divided between retirement, long-term savings, short-term savings, and fun money. The original version — created by MSN Money’s Richard Jenkins — is more structured and savings-focused than some simplified alternatives.4 This method can work especially well for couples with steady income who want a built-in system for prioritizing savings without needing to micromanage every expense.

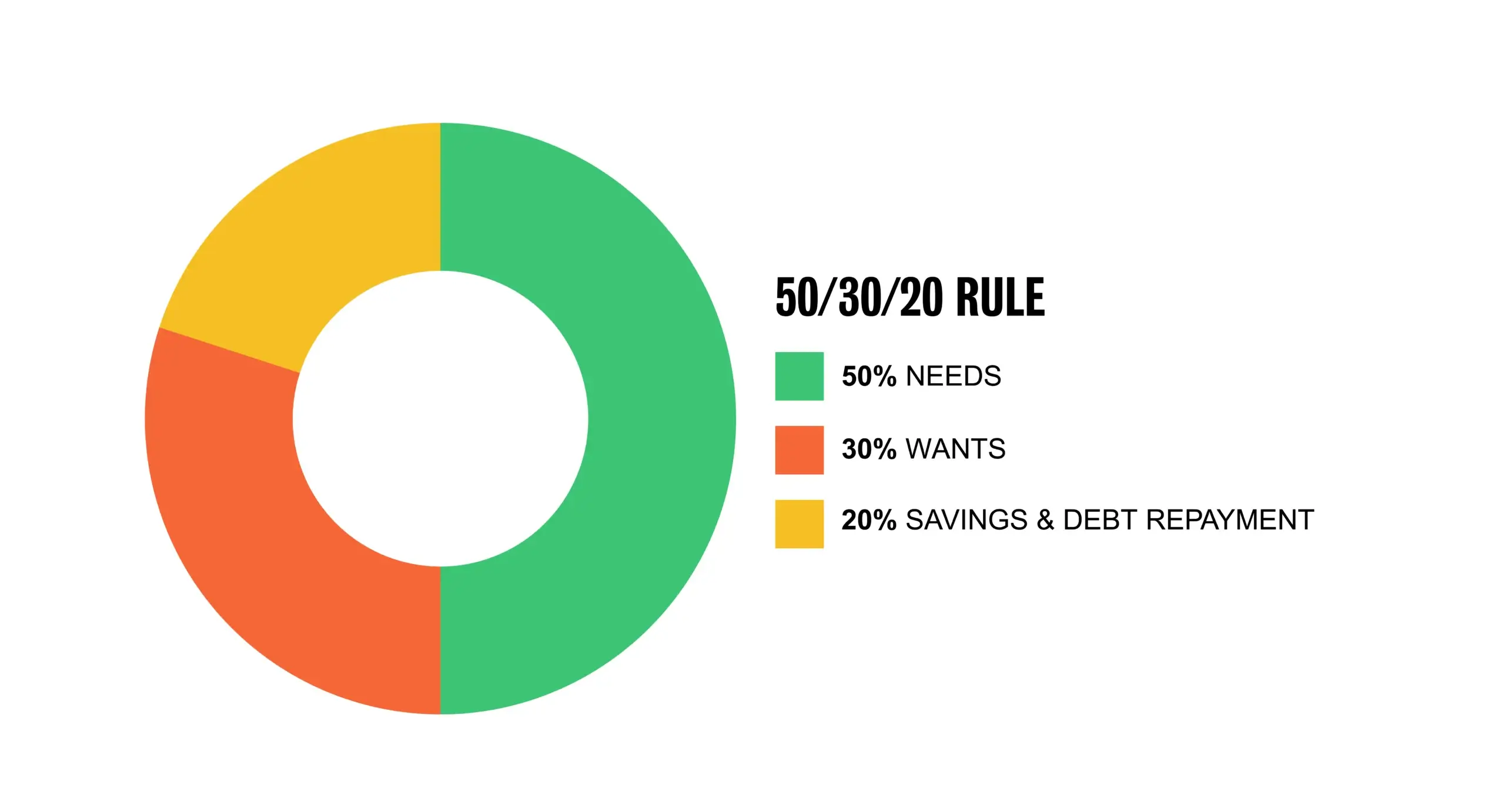

You could also try the popular 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings or debt payments. It’s a widely known method that’s appreciated for its simplicity and flexibility.5

For couples who like to track every dollar, zero-based budgeting might be a good fit. This method assigns every dollar a purpose so your income minus expenses equals zero. It takes a bit more attention but gives you full visibility into where your money is going.6

Learning how to budget as a couple is a process — you might start with one method and tweak it as your needs evolve. If you’re unsure where to begin, try WECU’s Budget Calculator or check out Making a Budget for a step-by-step guide. The best method is the one you’ll actually use — and that helps you make progress together.

8. Communicate Openly and Make Sure You’re on the Same Page

Budgeting isn’t a one-time conversation. One of the most important parts of budgeting for couples is regularly checking in to stay aligned on goals, spending, and anything that’s changed. Whether it’s a job shift, a surprise expense, or a new priority, talking things through helps you make adjustments together — instead of reacting separately.

You don’t need to do a deep dive every week. A monthly or quarterly check-in works well for most couples. Keep it casual — talk over coffee, make it part of a walk, or schedule a “budget date night.” Use the time to check in on what’s working — and where you might need to fine-tune your plan.

If you’re not sure where to begin, here are a few conversation starters to try:

- What’s one financial goal we’re both excited about right now?

- Are there any upcoming expenses we should plan for together?

- Have our spending habits changed recently — and how do we feel about that?

- What does financial security look like to each of us?

- How did your family talk about money growing up?

- If we had an extra $1,000 next month, what would we do with it?

These conversations don’t have to be perfect — they just need to happen. Over time, they’ll help you stay connected, flexible, and focused on what matters most to you both.

9. Celebrate Milestones

Reaching a financial goal — no matter the size — is worth acknowledging. Whether you’ve paid off a credit card, saved for a vacation, or hit an emergency fund target, taking a moment to celebrate can keep you motivated and remind you how far you’ve come.

Celebrating doesn’t have to mean spending big. It could be as simple as a home-cooked meal, a coffee date, or a day trip to your favorite spot. The point is to recognize the effort you’ve both put in — and to make space to enjoy the progress you’re making together.

These moments can reinforce the good habits you’ve built, create a sense of momentum, and deepen your connection as a team. It’s easy to focus on what’s next, but pausing to celebrate helps you appreciate what you’ve already achieved.

Frequently Asked Questions About Budgeting as a Couple

How should couples split their finances?

There’s no universal rule — some couples split everything evenly, while others divide expenses based on what feels fair for their situation. There are different approaches to how couple split their finances. What matters most is open communication and a system you both agree on.

How to budget as a couple?

Start by talking about your goals, tracking income and expenses, and choosing a budgeting method that fits your goals and lifestyle. Learning how to budget as a couple means staying flexible and working as a team — especially when needs, goals, and finances shift.

What is the 50/30/20 rule for married couples?

It’s a popular budgeting method that suggests putting 50% of income toward needs, 30% toward wants, and 20% toward savings or debt.

How to save money as a couple?

To explore how to save money as a couple, try setting shared goals, cutting back on nonessentials, and automating your savings. Even small changes can add up when you’re working together.

Should couples have joint or separate bank accounts?

It depends on your preferences. Some couples prefer full transparency with joint accounts, while others keep some finances separate. You can also combine both approaches with a hybrid setup.

How often should couples talk about money?

Monthly or quarterly check-ins work well for most couples. Pick a time that feels manageable and use it to review your budget, adjust goals, and talk through anything that’s changed.

References

- Baek, H. Y., Chenail, R., & Neymotin, F. “Financial Transparency and Marital Satisfaction.” Financial Planning Research Journal, 2023, https://sciendo.com/pdf/10.2478/fprj-2023-0004. Accessed April 23, 2025.

- S. Bureau of Labor Statistics. “Consumer Expenditures – 2023.” https://www.bls.gov/news.release/pdf/cesan.pdf. Accessed April 13, 2025.

- “What Does It Mean to Pay Yourself First?” https://www.thrivent.com/insights/budgeting-saving/what-does-it-mean-to-pay-yourself-first. Accessed April 13, 2025.

- The Penny Hoarder. “60% Solution Is a Simple Budget Strategy That Works for Anyone.” https://www.thepennyhoarder.com/budgeting/simple-budget/. Accessed April 13, 2025.

- “The 50/30/20 Budget Rule Explained With Examples.” https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp. Accessed April 13, 2025.

- “Zero-Based Budgeting: Benefits and Drawbacks.” https://www.investopedia.com/ask/answers/051515/what-are-advantages-and-disadvantages-zerobased-budgeting-accounting.asp. Accessed April 13, 2025.